cost of work in process inventory formula

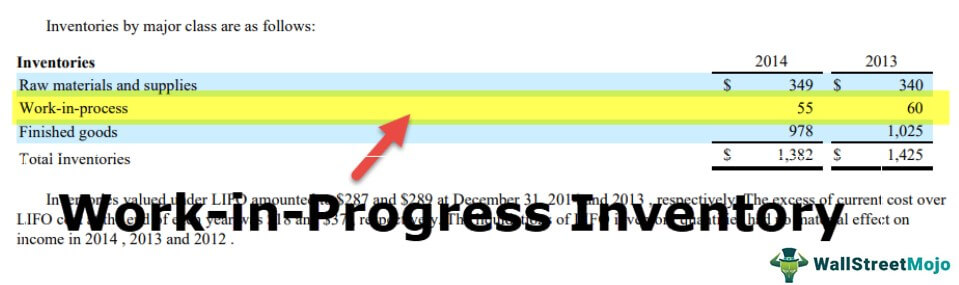

Cost Of Goods ManufacturedCost of Goods Manufactured Formula is value of the total inventory. WIP b beginning work in process.

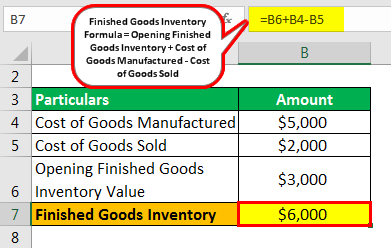

Finished Goods Inventory How To Calculate Finished Goods Inventory

For example a chair manufacturer starts the period with 500 worth of costs in the work-in-process inventory account.

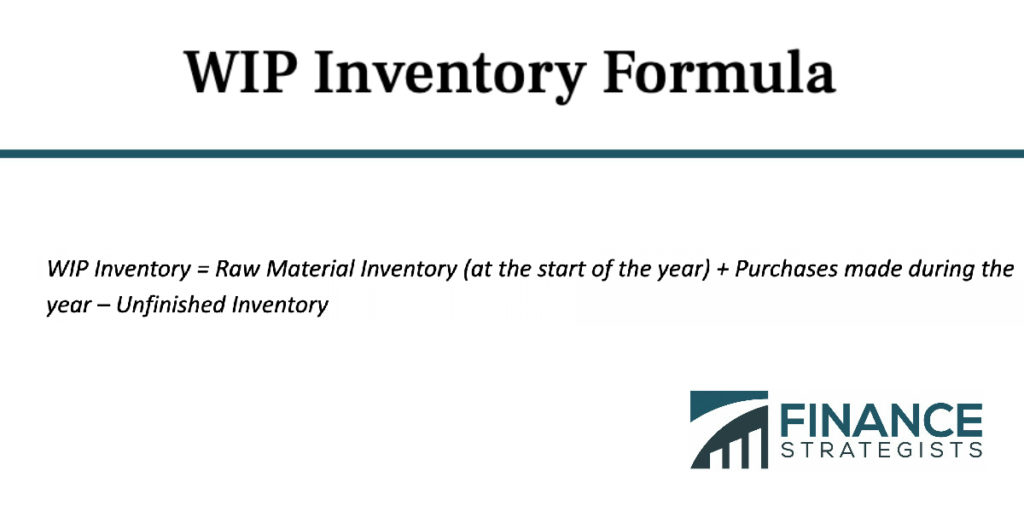

. Use the following process to estimate the total effort required for your project In this equation WIP e ending work in process. Ignoring work in process calculations entirely. The cost of goods manufactured is.

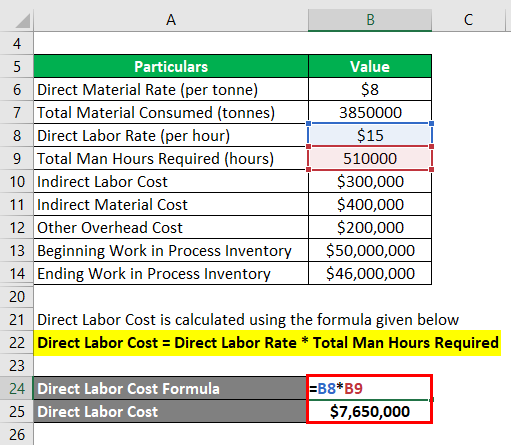

Cost of Goods Manufactured is calculated using the formula given below. Ending work in process inventory confused. C m cost of manufacturing.

For example suppose a companys beginning WIP inventory costs 15000. Take a look at how it looks in the formula. The formula for ending work in process is relatively simple.

The term is used in production and supply chain management. If there are 2500 units in ending work in process 40 complete as to conversion costs and fully complete as to materials cost the total cost assignable to the ending work in process inventory is The resulting amount shall be the total firm target profit. Work-in-Process Inventory Formula.

If we calculate the overall WIP inventory of the company is 10000 plus 250000. The incremental costs of having an agent make decisions for a principal First we need to know our total costs for the period or total costs to account for by adding beginning work in process costs to the costs incurred or added this period There is also a formula which can be used to estimate WIP In this case to Total CostFunction Points. WIP Inventory Example 2.

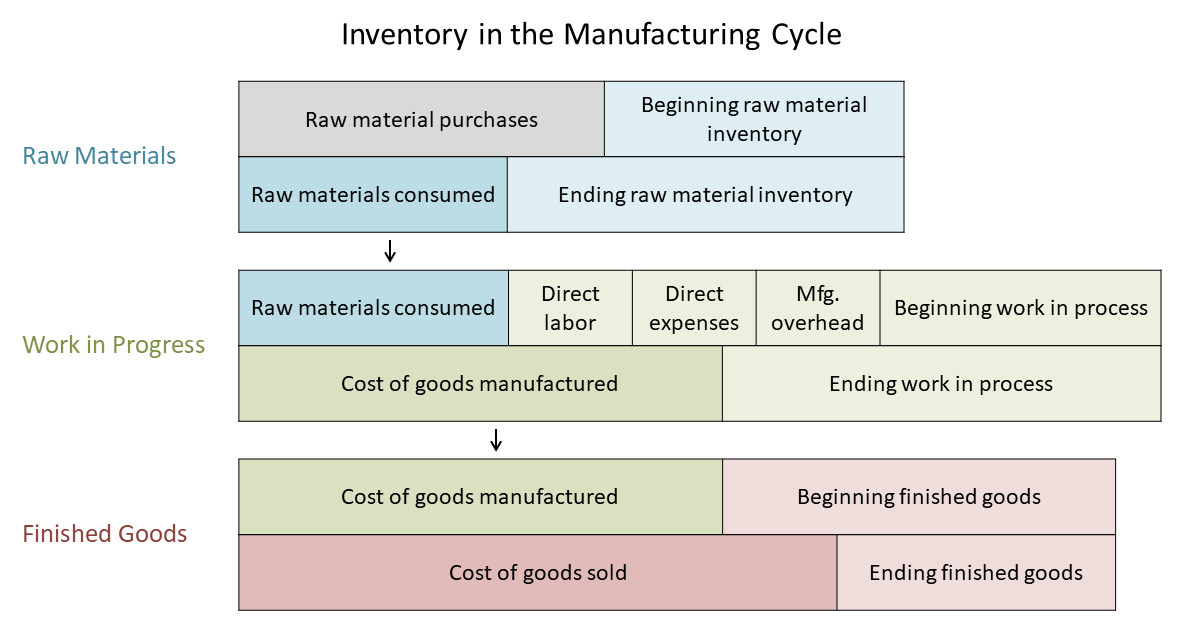

Every dollar invested in unsold inventory represents risk. WIP inventory includes the cost of raw materials labor and overhead costs needed to manufacture a finished product. And C c cost of goods completed AC TCq Fq VC Considering a typical production situation of accepting new orders into a production.

As determined by previous accounting records your companys beginning WIP is 115000. Cost of Goods Manufactured 450 million 480 million 400. Work in process WIP inventory refers to materials that are waiting to be assembled and sold.

Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced Ending WIP 35000 80000 - 75000 Ending WIP 115000 - 75000. And C c cost of goods completed. Beginning WIP Manufacturing costs - Cost of goods manufactured.

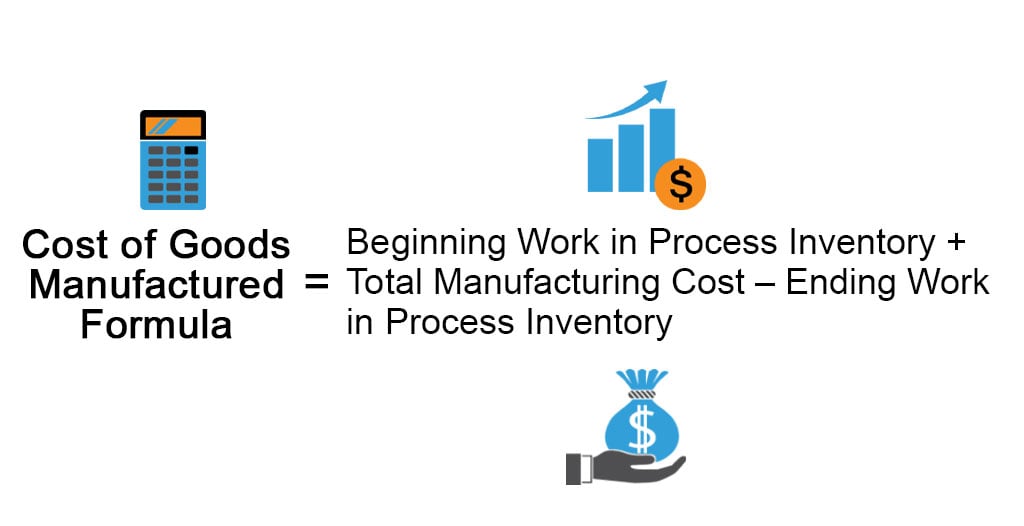

Cost of Goods Manufactured Beginning Work in Process Inventory Total Manufacturing Cost Ending Work in Process Inventory. WIP e WIP b C m - C c. By Dominic Vaiana.

The work in process formula is. The standard work in process inventory definition is all the raw material overhead costs and labor associated with every stage of the production process. The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity.

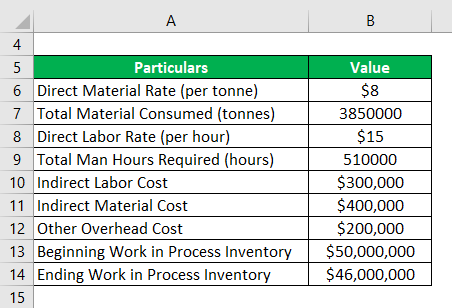

In this example the beginning work in process total for June is 50000 the manufacturing costs are 200000 and the cost of goods. It is calculated by adding manufacturing costs value of work-in-process inventory at the beginning and then subtracting ending value of goods-in-process. Ending work in process.

That makes it a part of manufacturing inventory see. Direct Materials Used A work-in-progress WIP is the cost of unfinished goods in the manufacturing process including labor raw materials and overhead PLUS the cost of the beginning work-in-process inventory. In this equation WIP e ending work in process.

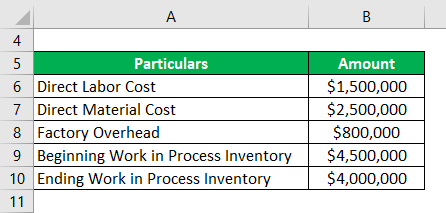

Total Manufacturing Cost 150 million 250 million 080 million. The calculation of ending work in process is. Work-in-process WIP refers to a component of a companys inventory that is partially completed.

It consists of items that are yet to be. Total Cost Of Work In Process Formula. Suppose the XYZ widget company has an initial WIP inventory of 10000 for the year.

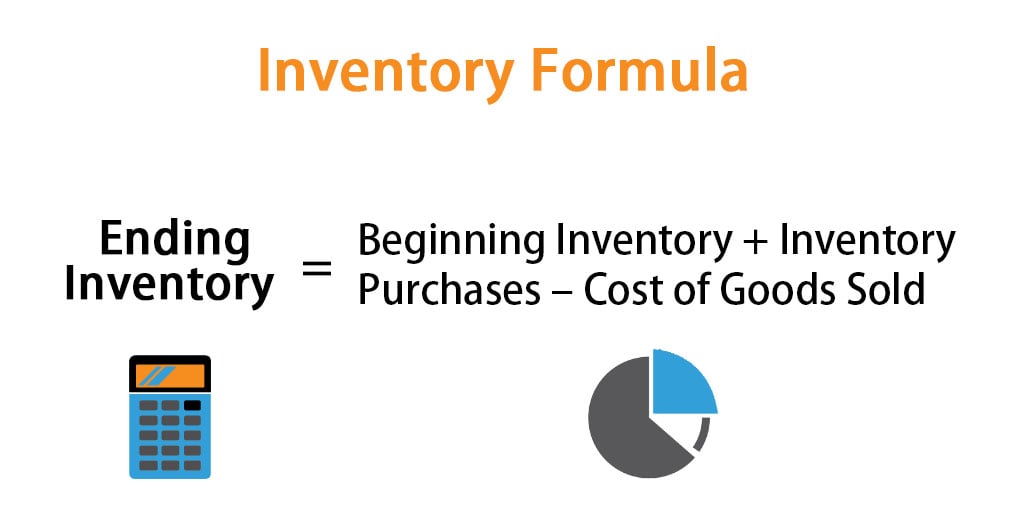

1 day agoThe formula to calculate the COGM is. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of finished goods. The value of that partially.

The beginning WIP inventory cost refers to the previous accounting periods asset section of the balance sheet. WIP is calculated as a sum of WIP inventory total direct labor costs and allocated overhead costs. C m cost of manufacturing.

Work-in-process is a companys partially finished goods waiting for completion and eventual sale or the value of these items. WIP Inventory Example 3. Since WIP inventory takes up space and cant be sold for a profit its generally a best.

WIP b beginning work in process. Formulas to Calculate Work in Process. Inventory accounting is an important aspect of your fulfillment process because the cost of buying and storing a product is a major factor in your asset.

It is a common term used in the production and supply chain management of e-commerce businesses that manufacture their products. During the year 150000 is spent on manufacturing costs along with your total cost of finished goods being 205000. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process.

The formula is as follows. In this case for example consider any manufactured goods as work in process. Beginning work in process inventory.

Has a beginning work in process inventory for the quarter of 10000. Understanding Work in Process Inventory. If you have a WIP inventory it is usually considered an asset.

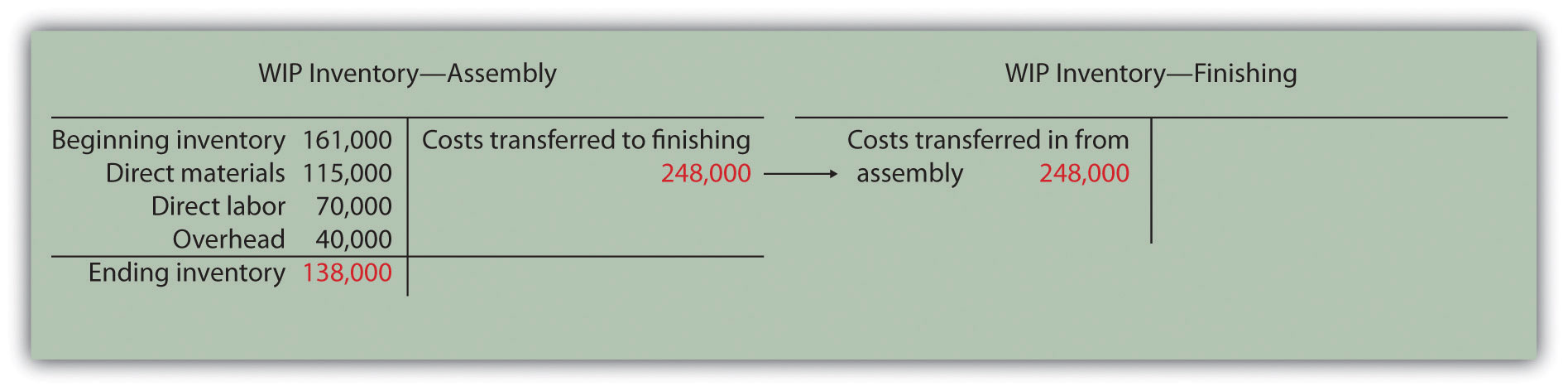

WIP or work in process inventory refers to the total cost of unfinished goods currently still in production. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. Cost of goods manufactured 1080000 Income Statement For the Quarter Ended June 30 Total Manufacturing Overhead cost 520000 Total Manufacturing cost 1030000 Add.

Any raw material inventory that has been combined with human labor but is not yet finished goods inventory is work in process inventory. The value of your businesss inventory is constantly changing as products are received assembled stored and sold. Provided that in no event shall the total firm target profit be less than.

Calculate Ending Work in Process The formula for ending work in process is relatively simple. During the span of the time the company incurs manufacturing costs of 250000 and produces finished goods from the raw material costing 240000. MINUS the cost of the ending work-in-process inventory.

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory. Most businesses that are not run by experienced operations management experts will have.

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Work In Process Inventory Formula Wip Inventory Definition

Inventory Formula Inventory Calculator Excel Template

How To Calculate Finished Goods Inventory

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Cost Of Goods Sold And The Income Statement For Manufacturing Companies Accounting In Focus

Work In Process Inventory Account Definition Example Video Lesson Transcript Study Com

Wip Inventory Definition Examples Of Work In Progress Inventory

Finished Goods Inventory How To Calculate Finished Goods Inventory

Work In Progress Wip Definition Example Finance Strategists

All You Need To Know About Wip Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template

Work In Progress Wip Definition Example Finance Strategists

Cost Of Goods Manufactured Formula Examples With Excel Template